Articles

How Trading Markets Work? Forex, Stocks & Crypto Guide

Introduction

You’re reading financial news and see “gold hits new highs” or “US indices close in the red.” Cool. But what does that actually mean? More importantly — how do trading markets work, and why should you care?

If you’re honest, probably not much on both counts. Most people nod along when traders talk about “the market” like it’s some monolithic thing. However, it’s not. In fact, there are multiple markets, each working completely differently. Understanding how trading markets work isn’t optional if you’re serious about trading — it’s literally the foundation of everything else you’ll learn.

Here’s what confuses people: they think trading is just “buy low, sell high.” That’s like saying cooking is just “apply heat to food.” Technically true, but missing about 95% of what actually matters. For instance, how does buying even happen? Who’s on the other side? Why can you trade Bitcoin at 3 AM but not Apple stock? These are the real questions when learning how trading markets work.

This guide breaks down how the five major trading markets actually function: forex (currency trading), stocks (company ownership), cryptocurrency (digital assets), indices (market baskets), and futures (contract-based trading). Each operates on different principles. Moreover, each has different hours, different risks, different capital requirements. By the end, you’ll know which market matches your situation — and more importantly, which ones don’t.

Let’s start with the biggest market most people have never heard of.

How the Forex Trading Market Works: Decentralized Currency Trading

The forex market is massive. Like $9.6 trillion traded daily massive. That’s more than all the world’s stock markets combined. And yet, ask someone on the street what forex is, and you’ll probably get a blank stare.

Foreign exchange — forex or FX for short — is where currencies trade. Essentially, every time you’ve exchanged dollars for euros at an airport, you’ve participated in this market. (Though you probably got a terrible rate because airports are basically legalized robbery, but that’s another story.)

So how does the forex trading market work exactly? Let’s break it down.

How Forex Currency Pairs Work in Real Trading

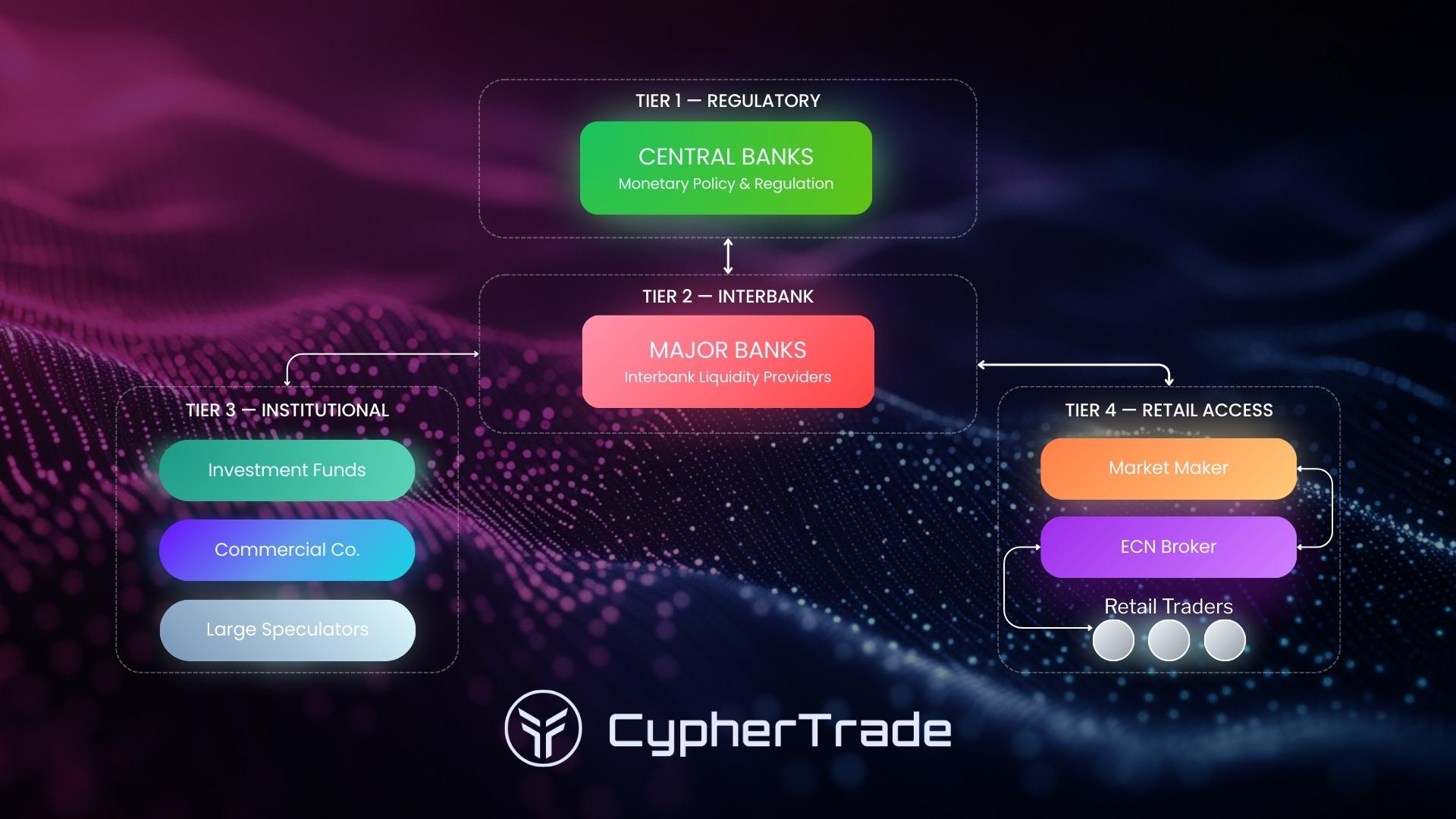

Here’s what makes forex weird: it’s completely decentralized. Essentially, there’s no “forex exchange building” where trading happens. Instead, it’s a massive electronic network connecting banks, financial institutions, hedge funds, corporations, and retail traders (that’s you). Because there’s no single location, there’s also no single price — quotes vary slightly between dealers.

When you trade forex, you’re always dealing with pairs. Simply put, you can’t just “buy euros” — you’re buying euros with something, usually dollars. For example, EUR/USD at 1.0850 means one euro costs $1.0850. The first currency (EUR) is the “base currency”, the second (USD) is the “quote currency”.

Think you’ll make money if the euro strengthens? Buy the pair. Conversely, think it’ll weaken? Sell it.

The mechanics: when you place a trade, your broker either matches you with another trader or takes the opposite side themselves. Typically, most retail traders use market makers who quote two prices — the bid (what they’ll pay you) and the ask (what they’ll charge you). The difference is the spread, which is part of your trading cost. On major pairs like EUR/USD, spreads might be 1-10 pips (0.0001-0.0010). On exotic pairs? Could be 50+ pips. Yeah, it adds up.

How Forex Market Hours and Trading Sessions Work

Forex trades 24/5. Specifically, it opens Sunday evening when Sydney wakes up and closes Friday afternoon when New York goes home. The handoff goes Sydney → Tokyo → London → New York. Rinse and repeat.

However, not all hours are equal. Generally, London session (8 AM to 4 PM GMT) sees the most action. When London and New York overlap (8 AM to 12 PM EST), that’s prime time — tightest spreads, most liquidity, biggest moves. In contrast, the Asian session tends to be quieter, which some traders love (less volatility) and others hate (less opportunity).

You can trade at 2 AM if you want. Obviously, whether you should is debatable.

Forex Leverage: How It Works and Associated Risks

Now we get to the part where beginners blow up their accounts.

Forex brokers offer insane leverage — 50:1, 100:1, even 500:1 internationally. With 50:1, your $1,000 controls $50,000. Sounds amazing, right? Double your money when the pair moves 2%!

However, it works both ways. That 2% move against you? Account gone.

Here’s the thing people don’t get: forex pairs barely move. For instance, EUR/USD might fluctuate 0.5-1% in a day. That’s why brokers offer leverage — without it, you’d need $100,000 to make meaningful returns on tiny price movements. Nevertheless, leverage is a chainsaw. Powerful tool, easy to lose a finger if you don’t know what you’re doing.

Why Most Forex Traders Lose Money

Most forex brokers report that 70-80% of retail traders lose money. The common thread? Overleveraging. Specifically, they risk 5-10% per trade instead of 1-2%. Works great until it doesn’t, then they’re writing angry Reddit posts about how forex is a scam.

It’s not a scam. Rather, it’s just unforgiving.

⚠️ LEVERAGE WARNING: With high leverage, a 1% adverse move can wipe out 50% or more of your account. In fact, most professionals risk 0.5-1% per trade max. Start smaller than you think you should.

How the Stock Market Works: Understanding Centralized Exchanges

Stock market basics are actually pretty simple once you cut through the jargon. To understand how trading markets work in the stock world, start here:

When you buy a stock, you’re buying a piece of a company. Own 100 shares of Apple? You own a tiny fraction of Apple. The company does well, your shares (theoretically) become more valuable. Similarly, company tanks, so does your investment.

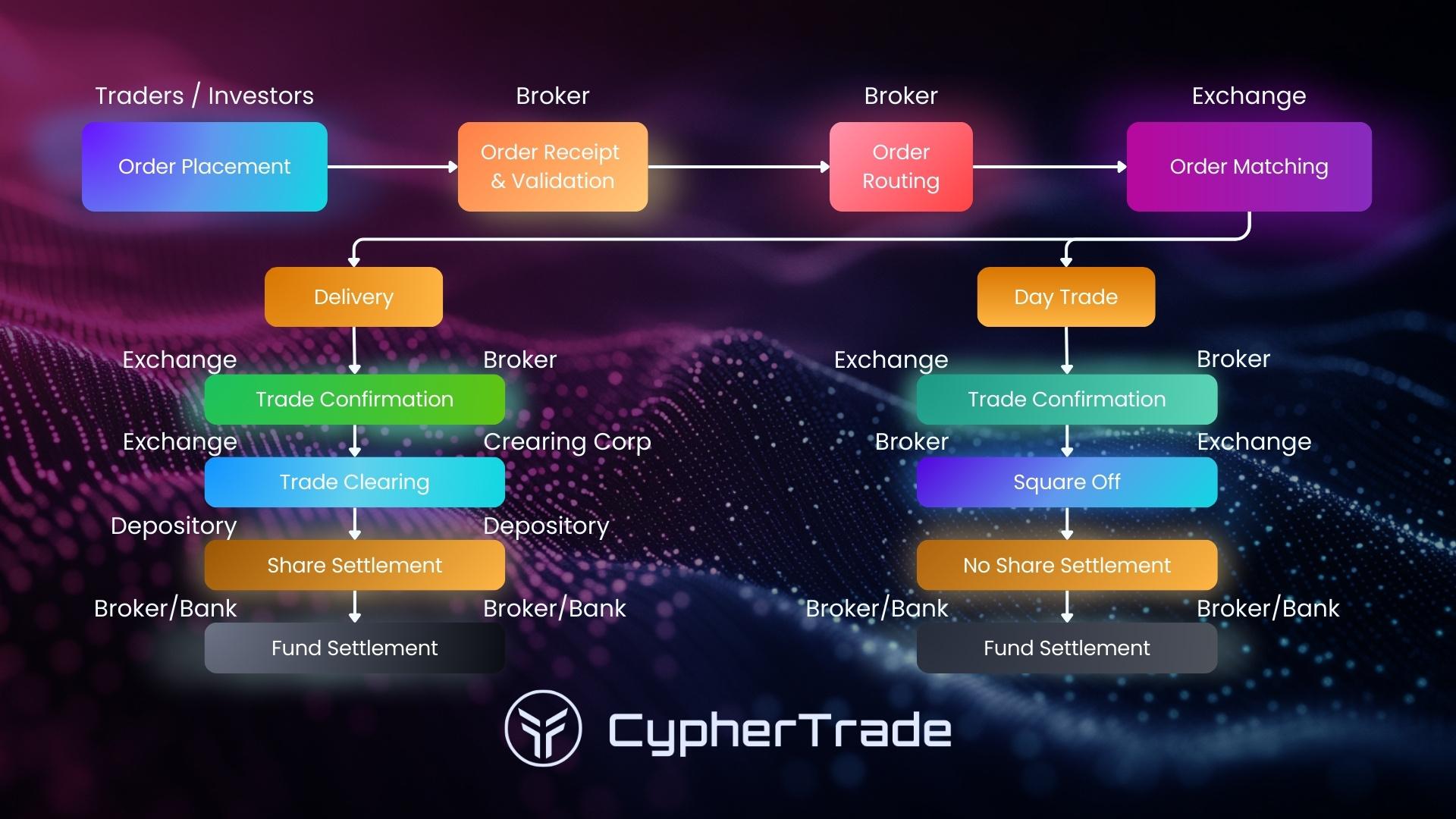

Unlike forex’s wild-west decentralized structure, stocks trade on actual exchanges. NYSE, NASDAQ, London Stock Exchange, etc. In other words, these are regulated marketplaces with strict rules. When you buy Apple stock, that order routes to NASDAQ, gets matched with a seller, executes in milliseconds. It’s all electronic now, but the principles haven’t changed since traders were shouting on the floor.

How Stock Market Order Matching Works

Stock prices move on supply and demand. More buyers than sellers? Price goes up. More sellers than buyers? Down. Simple.

What creates that supply and demand? Everything. Earnings reports, product launches, CEO tweets, economic data, sector trends, whether Mercury is in retrograde — okay, maybe not that last one, but sometimes it feels that way.

The difference from forex: you’re analyzing specific companies, not entire economies. Is Tesla overvalued? Is Apple releasing a revolutionary product? Will Disney’s streaming strategy pay off? It’s a different skill set than forex.

Order matching happens fast. Market orders execute immediately at the best available price. Limit orders sit there until your price hits (or don’t, if price doesn’t reach your level). The bid-ask spread — difference between what buyers will pay and sellers want — is usually pennies for liquid stocks. For thinly traded garbage? Could be dollars.

Order matching happens fast. Market orders execute immediately at the best available price. Limit orders sit there until your price hits (or don’t, if price doesn’t reach your level). The bid-ask spread — difference between what buyers will pay and sellers want — is usually pennies for liquid stocks. For thinly traded garbage? Could be dollars.

Stock Market Trading Hours and Regulations Explained

U.S. stock market: 9:30 AM to 4 PM Eastern, Monday through Friday. That’s it. Additionally, there’s pre-market (around 4 AM to 9:30 AM) and after-hours (4 PM to 8 PM), but volume is thin and spreads are wider. Generally, most retail traders stick to regular hours.

This creates a problem if you work 9-5. Essentially, you’re either trading on your phone at work (risky for your job) or sticking to swing trading (holding positions overnight or longer). Clearly, day trading stocks while working full-time is basically impossible unless you have a very understanding boss.

The regulatory bodies — SEC (Securities and Exchange Commission) and FINRA — are actually pretty strict. This is good and bad. Obviously, good because there’s less outright fraud than in less regulated markets. Unfortunately, bad because there are annoying rules like…

Understanding Capital Requirements for Stock Trading

The Pattern Day Trader rule. This one catches people off guard.

Make four or more day trades within five business days? Congratulations, you’re now a “pattern day trader” and need $25,000 minimum in your account. Drop below that? Can’t day trade anymore until you’re back above $25K.

The reasoning: protecting inexperienced traders from themselves. However, the reality: it creates a barrier that doesn’t exist in forex or crypto. Specifically, you can day trade forex with $1,000. Stocks? You need 25x that amount.

⚠️ PATTERN DAY TRADER WARNING: The $25K rule applies to margin accounts. Cash accounts have no minimum but you can’t day trade effectively due to settlement delays (T+2). Pick your poison.

There’s a workaround — cash accounts — but then you wait 2 days for trades to settle before you can use those funds again. Therefore, you either need $25K for a margin account or enough capital in a cash account to rotate while waiting for settlements.

One bright spot: fractional shares. Don’t have $3,000 for one Amazon share? No problem, buy $50 worth. It’s democratized stock investing, even if the day trading rules haven’t caught up.

How Cryptocurrency Trading Markets Work: 24/7 Digital Assets

Crypto is… different. Like “doesn’t play by anyone else’s rules” different.

To understand how cryptocurrency trading markets work, you need to forget almost everything you know about traditional finance. Cryptocurrencies are digital assets running on blockchain technology — a decentralized ledger that records every transaction across thousands of computers. Bitcoin, Ethereum, and about 20,000 other coins (most of which are either dead or scams, but hey) operate on various blockchain networks.

The big difference from traditional markets: crypto never sleeps. Ever. 24/7/365. Christmas Day? Trading. 3 AM Sunday? Trading. Consequently, markets can swing 10% while you’re sleeping and there’s nothing you can do about it except set stop-losses and hope they execute (spoiler: during extreme volatility, they sometimes don’t).

How Crypto Exchange Markets Operate

Most people trade crypto on centralized exchanges — Coinbase, Binance, Kraken, etc. Essentially, you deposit money, the exchange matches buyers with sellers, pretty standard stuff.

But here’s where it gets weird: different exchanges show different prices. For instance, Bitcoin might be $67,500 on Coinbase and $67,850 on Binance simultaneously. Why? No central clearinghouse. Each exchange is its own little economy. Naturally, arbitrage opportunities exist, but they’re usually small and disappear fast.

Exchanges use order books like stock exchanges — limit orders sitting at different price levels, market orders executing against them. Some newer protocols use automated market makers (AMMs) which is… honestly, that’s a whole separate article. Ultimately, point is, there are different mechanisms but the goal is the same: match buyers and sellers.

How Crypto Markets Work: Understanding 24/7 Trading Mechanics

Trading around the clock sounds great until you realize you can’t watch it around the clock. Unless you’re planning to develop a serious caffeine addiction and destroy your sleep schedule, you need risk management tools.

Stop-loss orders become non-negotiable in crypto. Set them, use them, don’t think you’re too smart to need them. You’re not. Nobody is.

Stop-loss orders become non-negotiable in crypto. Set them, use them, don’t think you’re too smart to need them. You’re not. Nobody is.

Volume varies throughout the day. Generally, Asian business hours, European business hours — these tend to see more action. Specifically, Sunday nights (EST) can be weirdly volatile as Asian markets wake up. Low volume periods mean wider spreads and higher slippage. As a result, your “market order” might execute way worse than expected when liquidity dries up.

Managing Cryptocurrency Market Volatility

Let’s talk about volatility. Bitcoin moving 5% in a day? Normal. Ethereum swinging 8%? Tuesday. Some random altcoin doubling then crashing 70%? Must be a day that ends in ‘y’.

This is both the appeal and the terror of crypto. On one hand, you can make money faster than in traditional markets. On the other hand, you can also lose it faster. Much faster.

The Operational Risks Nobody Talks About

Then there’s the operational risks nobody talks about until it’s too late. Exchanges get hacked. For example, it happened to Mt. Gox (lost 850,000 BTC). Happened to Bitfinex. Happened to dozens of others. Your coins sitting on an exchange? Not really your coins. Instead, the exchange controls the private keys. They go down, your money goes with them.

⚠️ CRYPTO SECURITY WARNING: “Not your keys, not your coins.” For serious holdings, use a hardware wallet. For trading money, spread across multiple exchanges. And yes, that exchange you trust totally could be the next FTX.

Regulatory and Leverage Risks in Crypto

Regulatory risk is real too. For instance, China bans crypto every six months (or unbans it, hard to keep track). Meanwhile, the SEC randomly decides various coins are securities. El Salvador makes Bitcoin legal tender. Every headline creates a price swing.

Some exchanges offer 100:1 leverage on crypto. Let that sink in. The most volatile retail-accessible asset class, leveraged 100x. Consequently, a 1% move against you = total loss. It’s gambling dressed up as trading, and the house (exchange) always wins because they collect funding rates.

Want to survive crypto? Therefore, start with spot trading (actually owning the coins), small positions. Leverage comes later, if ever.

Understanding How Trading Indices Work: Market Basket Approach

Quick question: can you buy the S&P 500?

No. It’s not a thing you can buy. It’s a number representing 500 stocks mashed together. The Dow Jones? Also just a number (and a weirdly calculated one at that).

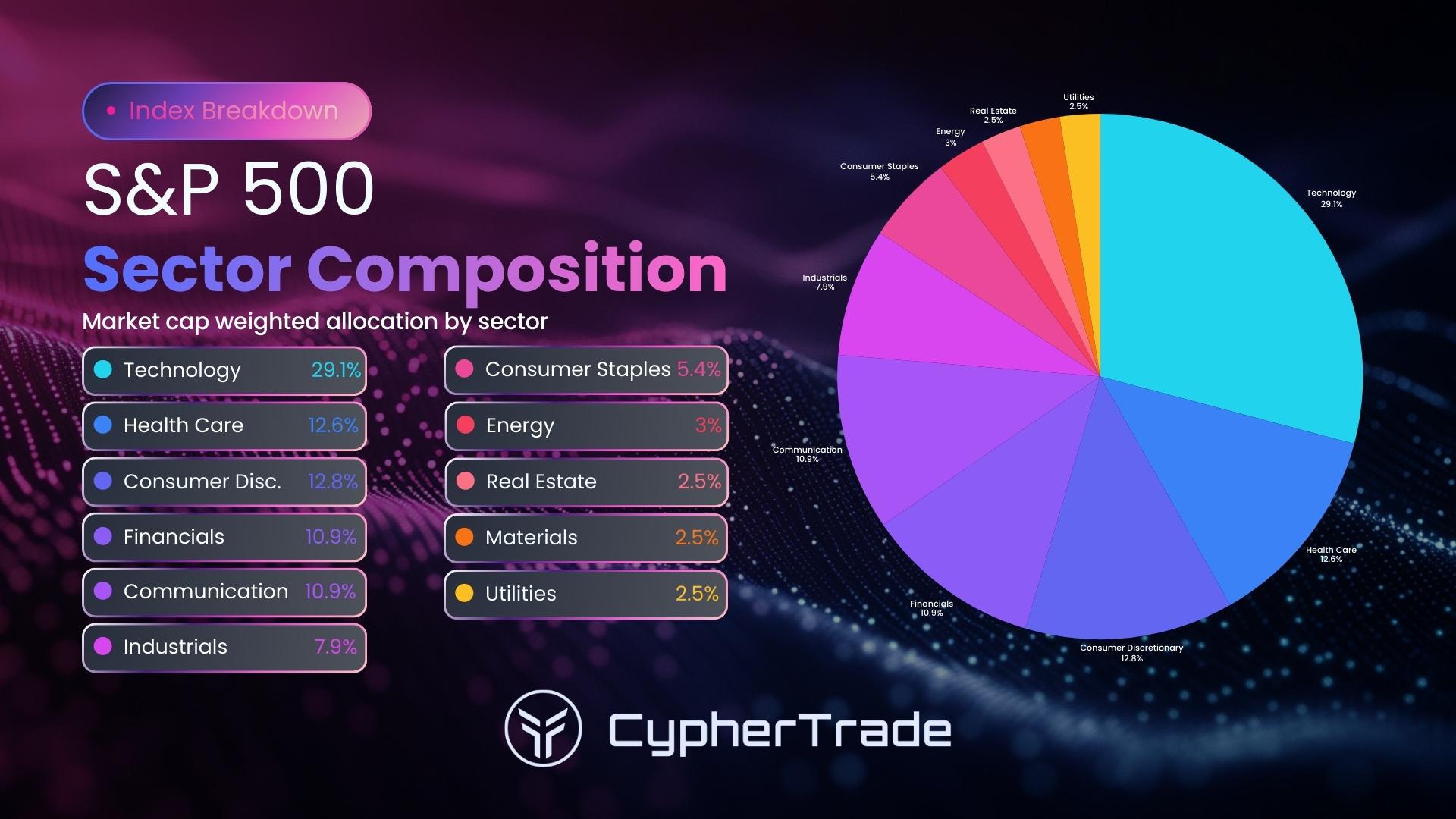

If you want to understand how trading markets work with indices, first understand this: indices are measurements, not assets. Specifically, they track groups of stocks to give you a snapshot of broader market performance. S&P 500 up 1%? Large-cap U.S. stocks generally did well. NASDAQ down 2%? Tech took a beating.

What you can trade: instruments based on these indices. Index futures, ETFs, CFDs (depending on your location). Each has trade-offs.

How Index Prices Are Calculated

Not all indices are created equal. Specifically, the S&P 500 uses market cap weighting — bigger companies like Apple and Microsoft move the index more than smaller ones. Makes sense, they represent more total value.

The Dow Jones? Uses price weighting. Higher stock price = more influence, regardless of company size. Frankly, it’s an outdated method from 1896 that we keep using because… tradition? Goldman Sachs with a $400 stock price affects the Dow more than a company worth 10x more with a $40 stock. Weird, but that’s how it works.

Equal-weight indices give each component the same influence. Less common but they exist.

Why does this matter? Because knowing how an index is weighted helps you understand what actually moves it. For example, if Apple reports blowout earnings, the S&P 500 will jump because Apple is like 7% of the index. In contrast, same earnings from a smaller component? Barely registers.

How Index Trading Markets Work Through Derivatives

Index trading appeals to people who want market exposure without picking individual stocks. Your thesis: “The overall U.S. market will rise based on Fed policy”? Trade an S&P 500 futures contract or SPY ETF. Clearly, way easier than analyzing 500 companies individually.

You can also short indices, profiting from market declines. For instance, in 2022 when everything tanked, short S&P traders made bank. Conversely, in 2023 when everything recovered, they got destroyed. It cuts both ways.

Ways to trade indices:

Index Futures – Standardized contracts on exchanges like CME. Leverage is built in (typically 10-20x), which means… yeah, risk management matters.

ETFs – Actually own shares in a fund that holds the index components. SPY, QQQ, IWM — these track major indices. Lower leverage than futures, more accessible for smaller accounts.

Options – Right (but not obligation) to buy/sell at specific prices. Complex, probably skip these until you know what you’re doing.

CFDs – Contracts for difference, common outside the U.S. Basically betting on price movement without owning anything. High leverage, high risk.

Each instrument has different costs, leverage, tax treatment, and complexity. Obviously, do your homework before jumping in.

How Futures Trading Markets Work: Contract-Based System

Futures are where trading gets properly complicated. But also potentially profitable if you know what you’re doing (big if).

Understanding how futures markets work requires a mindset shift. A futures contract obligates you to buy or sell something at a specific price on a specific date. For example, crude oil futures? Agreeing to exchange 1,000 barrels at $75/barrel on December 31st. E-mini S&P 500? $50 times the index value, cash-settled at expiration.

Key word: “obligates.” This isn’t like buying stocks where you just hold forever. Instead, futures contracts expire. You either close them before expiration or… well, theoretically accept delivery of 1,000 barrels of oil. (Please don’t actually do this. Your apartment complex will not appreciate it.)

Understanding How Futures Contracts Work

In practice, 99% of retail futures traders close positions before expiration. Bought a crude oil contract? You sell an identical one to offset it. Never deal with actual oil barrels.

Futures cover everything: agricultural (corn, soybeans, cattle), energy (oil, natural gas), metals (gold, silver, copper), financials (stock indices, bonds, currencies), even weather and volatility. In other words, if you can think of it, someone’s probably made a futures contract for it.

The market runs nearly 24/5, Sunday evening through Friday afternoon with brief maintenance breaks. Consequently, way more accessible than stock market hours.

Why Trade Futures Over Other Markets?

Why trade futures instead of stocks or forex? Few reasons:

- Tax advantages (60/40 treatment in the U.S.)

- Lower trading costs than stocks

- High liquidity in major contracts

- Can trade everything from beans to bonds in one account

However, there’s a catch. Actually, several catches.

Futures Margin Requirements Explained

Futures margin isn’t like stock margin. It’s not a loan — it’s a performance bond. Essentially, you deposit money proving you can cover potential losses. For example, initial margin to open a position might be $10,000-15,000 for an E-mini S&P contract representing over $200,000 in market exposure.

See the problem? You’re controlling $200,000 with $10,000. Roughly 20:1 leverage. Contract moves 1% against you? You’re down $2,000 on a $10,000 margin deposit. That’s 20% of your initial margin on a 1% market move.

It gets worse. Specifically, if your account drops below maintenance margin (usually slightly below initial margin), you get a margin call. Add money immediately or your broker liquidates your position. No discussion, no warning, just closed. Often at the worst possible price.

The system has two margin levels:

- Initial margin – What you need to open a position

- Maintenance margin – Minimum to keep it open (usually 75-80% of initial)

Futures are marked to market daily. Win or lose money? It’s added or subtracted from your account every day. This is different from stocks where unrealized gains/losses are just on paper until you sell.

⚠️ FUTURES WARNING: Professional traders use futures. Retail beginners usually shouldn’t. The leverage is substantial, the markets move fast, and margin calls are merciless. Paper trade for months first, minimum.

Fortunately, micro contracts exist now — 1/10th the size of standard contracts, making futures accessible with smaller accounts. E-micro S&P 500, micro crude oil, etc. These are actually reasonable for learning, unlike standard contracts that can devastate small accounts.

The Commodity Futures Trading Commission CTFC has educational resources that won’t sugarcoat the risks. Read them.

Trading Markets Comparison: Quick Reference Guide

Okay, you’ve made it through all five markets. Here’s the cheat sheet comparing how trading markets work across different types:

| Feature | Forex | Stocks | Crypto | Indices | Futures |

| Trading Hours | 24/5 | 9:30am-4pm EST | 24/7/365 | Varies | 23/5 |

| Starting Capital | $500-$1,000 | $0-$25,000 | $100+ | $1,000+ | $2,000-$10,000 |

| Typical Leverage | 50:1 to 100:1 | 2:1 to 4:1 | Up to 100:1+ | 10:1 to 20:1 | 10:1 to 20:1 |

| Market Structure | Decentralized | Centralized | Mixed | Derivatives | Centralized |

| Daily Volatility | Low-Medium | Medium | Extreme | Medium | Medium-High |

| Regulation | High | Very High | Low-Medium | High | Very High |

| Main Risk | Leverage | Company risk | Everything | Systemic | Margin calls |

| Best For | Macro traders | Analysts | Degen gamblers | Diversification | Pros |

| Learning Curve | Medium | Medium-High | Medium-High | Medium | High |

| Realistic for beginners? | Yes, with discipline | Yes, with capital | Maybe, with caution | Yes | Probably not |

Brutal truth: None of these markets are “easy.” In fact, anyone telling you otherwise is selling something (probably a course). Each has unique challenges. Therefore, pick based on your situation, not promises of easy money.

Practical Guide: How to Choose Which Trading Market Works for You

Alright, decision time. Now that you understand how trading markets work, let’s figure out which one matches your situation.

Matching Your Situation to How Different Markets Work

First filter: schedule. Work 9-5? Stock day trading is basically out unless you want to get fired. However, forex works evenings/nights when London or Asian sessions run. Meanwhile, crypto is always open but that’s not necessarily good — more opportunities to make mistakes at 2 AM.

Second filter: capital. Got $500? Forex is viable, crypto works, stocks are limited (cash account only), indices maybe (depends on instrument), futures probably not. On the other hand, got $25,000? Everything’s on the table.

Third filter: temperament. Honest question: can you handle checking your phone and seeing a 10% loss? If not, crypto’s probably not for you. In contrast, need to analyze companies and fundamentals? Stocks. Similarly, like macro economics and global events? Forex. Want diversification without stock picking? Indices.

Fourth filter: risk tolerance. Despite what people claim, this isn’t just “how much can you lose.” Moreover, it’s also about how loss affects you psychologically. For instance, some people lose $500 and shrug. Others lose $500 and can’t sleep for a week. Know yourself.

The Actual Path Forward (Not the BS Version)

Step one: Education, not gambling. Pick ONE market. Don’t try to learn all five. For example, BabyPips for forex is free and excellent. Additionally, Investopedia has solid guides for stocks. YouTube has good crypto content (and terrible crypto content — learn to distinguish).

Step two: Demo trade for 2-3 months minimum. Not a week. Not “until you have one good week.” Months. Furthermore, most brokers offer paper trading accounts. The money’s fake, the learning’s real. Consequently, you’ll discover your strategy has holes. Your risk management sucks. You overtrade when bored. Therefore, better to learn this with fake money.

Step three: Small live account. Not your life savings. Not money you need. Instead, money you can genuinely afford to lose. Because statistically, you’re going to lose it. In fact, most traders blow up their first account. It’s almost a rite of passage. Make it a $500 lesson, not a $10,000 disaster.

Step four: Journal everything. Every trade, the reasoning, the result, what you learned. Otherwise, trades blur together. That “sure thing” that failed? You’ll repeat it in a month if you don’t write it down. Winners and losers, document both.

Step five: Focus on process, not profits. This is the hardest part psychologically. Obviously, you want to make money NOW. However, profitable traders are profitable because they follow a process consistently, not because they hit home runs. In other words, a losing month following your strategy is better than a winning month going rogue.

Setting Realistic Timeline Expectations

How long until you’re profitable? Honest answer: 1-3 years if you’re dedicated and lucky. Moreover, many traders never get there. Not trying to discourage you — just being realistic. After all, trading is a skill like piano or chess. Nobody sits down and plays Carnegie Hall in six months.

Conclusion and Next Steps

So, how do trading markets work? And more importantly, which one should you trade?

Here’s the summary: Forex operates as a decentralized global network where currencies trade 24/5 with high leverage and tight spreads. Stock markets provide regulated access to company ownership during specific hours with strong protections but higher capital requirements. Meanwhile, crypto markets offer 24/7 trading with extreme volatility and emerging regulation. Indices give diversified market exposure without stock picking. Finally, futures provide contract-based trading across all asset classes with substantial leverage and strict margin requirements.

Each market has trade-offs. In other words, there’s no perfect choice, only the choice that fits your situation.

Your next move: pick one market. Not five. One. The one that aligns with your schedule, capital, and interests. For instance, forex if you like macro economics and flexibility. Stocks if you enjoy analyzing companies. Crypto if you’re comfortable with volatility and technology. Indices if you want broad exposure. Futures if you’re experienced and well-capitalized (note: beginners should probably skip this one initially).

After choosing, commit to education. Actually commit, not “watch a few YouTube videos” commit. For example, BabyPips’ School of Pipsology for forex. Investopedia for stocks. Quality resources exist — use them.

Then demo trade. For months, not days. Learn the mechanics, test strategies, make mistakes with fake money. Furthermore, most brokers offer paper trading. Use it.

Eventually, transition to a small live account. Emphasis on small. Money you can afford to lose, because you probably will. In fact, first accounts are tuition payments to the market. Make it affordable tuition.

And remember: trading involves substantial risk of loss. Most beginners lose money. Not some, not many — most. However, the difference between those who eventually succeed and those who quit isn’t talent. Rather, it’s treating this like a skill that takes years to develop, not a shortcut to quick money.

The markets will be here tomorrow. Next month. Next year. Therefore, there’s no rush. Build skills properly, manage risk obsessively, and focus on the process.

Maybe you’ll make it. Many don’t. But if you’re going to try, do it the right way.

Frequently Asked Questions About How Trading Markets Work

Real questions from actual beginners, with honest answers about how different trading markets work:

Which market is “best” for beginners?

There isn’t one. Seriously. Forex has low barriers to entry but high leverage risk. On the other hand, stocks are straightforward but need more capital for day trading. Meanwhile, crypto’s exciting but volatile as hell. The “best” market is the one that fits your schedule, capital, and doesn’t make you want to throw your laptop out the window.

I’d personally start with forex or stocks (cash account) because they’re established, regulated, and have tons of educational resources. However, I’m biased based on my journey. Your mileage may vary.

How much do I ACTUALLY need to start?

Minimums:

- Forex: $500-1,000 realistic minimum (you can start with less but risk management becomes impossible)

- Stocks: $0 for cash accounts, but realistically $2,000-5,000 to trade effectively with settlement rules. $25,000 for day trading.

- Crypto: $500+ recommended after fees

- Futures: $5,000-10,000 for micro contracts, $25,000+ for standard contracts

These are realistic numbers, not broker minimums. Yes, you can open a forex account with $50. Nevertheless, you shouldn’t.

Can I trade multiple markets at once?

Can you? Sure. Should you? Probably not at first.

Each market has different behaviors, optimal times, analysis methods. Therefore, trying to watch forex, day trade stocks, and catch crypto moves simultaneously is a recipe for mediocrity in all three. Master one first, then expand if you want.

How long before I can quit my job and trade full-time?

Oh boy. Real talk: most people never get there. Understanding how trading markets work is just step one. Those who do typically take 3-5+ years building skills and capital. You need:

- Consistent profitability (6-12+ months minimum track record)

- Enough capital that realistic returns cover living expenses

- Emergency fund for drawdown periods

- Psychological resilience for income uncertainty

If someone’s selling a course promising you can quit in six months, they’re lying. In fact, their income comes from selling courses, not trading.

The Truth About Social Media Trading Gurus

What about those Instagram traders with Lambos?

99% bullshit. They’re either:

- Faking it (rented cars, demo accounts)

- Made money once and lost it all later

- Selling courses/signals (that’s their real income)

- Scammers

- The 1% who actually made it (and aren’t representative)

Real profitable traders are usually boring. They’re not on Instagram flexing. Instead, they’re optimizing risk-reward ratios and back-testing strategies.

Is trading just gambling?

Trading without a plan, risk management, or edge? Absolutely gambling. In fact, worse odds than blackjack, honestly.

However, trading with a tested strategy, proper risk management, statistical edge, and discipline? It’s speculation with a positive expected value over time. Still risky, still can lose money, but not pure gambling.

The line between the two is preparation and process. Unfortunately, most beginners are gambling without realizing it.

Do I need to watch charts all day?

Depends on your style. Obviously, day traders, yes. Swing traders holding days/weeks, no. Position traders holding months, definitely not.

The idea that you need to be glued to screens 10 hours a day is mostly wrong. In fact, that’s often overtrading. Actually, some of the best traders I know check their positions twice a day and spend more time analyzing than executing.

What’s the biggest mistake beginners make?

Overleveraging. Hands down.

Honestly, it’s not lack of knowledge, bad strategies, or wrong markets. Rather, it’s risking too much per trade, overleveraging, and blowing up accounts before they learn anything. Simply put, risk 1% per trade and you can be wrong 20 times in a row and survive. Conversely, risk 10% per trade and 10 losses = game over.

Risk management fundamentals is boring. It’s not sexy like “10 pips a day” strategies. However, it’s what separates traders who survive from those who become cautionary tales.