Articles

Forex Market Hours: Best Sessions to Trade

I’m going to be honest with you — I wasted my first six months of trading because nobody explained forex market hours properly. I’d spot what looked like a textbook setup on EUR/USD, pull the trigger, and then… nothing. Price would just sit there. Sideways. For hours. Eventually my stop would get clipped by some random spike, and I’d be left wondering what went wrong.

The setup wasn’t the problem. My timing was.

See, I was trading during the Asian session when EUR/USD moves about as much as a parked car. The pattern was fine. The execution window? Terrible.

Here’s what took me way too long to figure out: forex market hours matter just as much as your entry signals. Maybe more. The market runs 24 hours a day, five days a week, sure — but that doesn’t mean every hour deserves your attention. Liquidity comes and goes. Volatility spikes and flatlines. And if you’re not aware of these rhythms, you’re basically gambling on when price decides to wake up.

At CypherTrade, we see traders make this mistake constantly. They’ve got solid strategies, decent risk management, but their timing is all over the place. So let’s fix that.

The Four Sessions (And Why You Should Care)

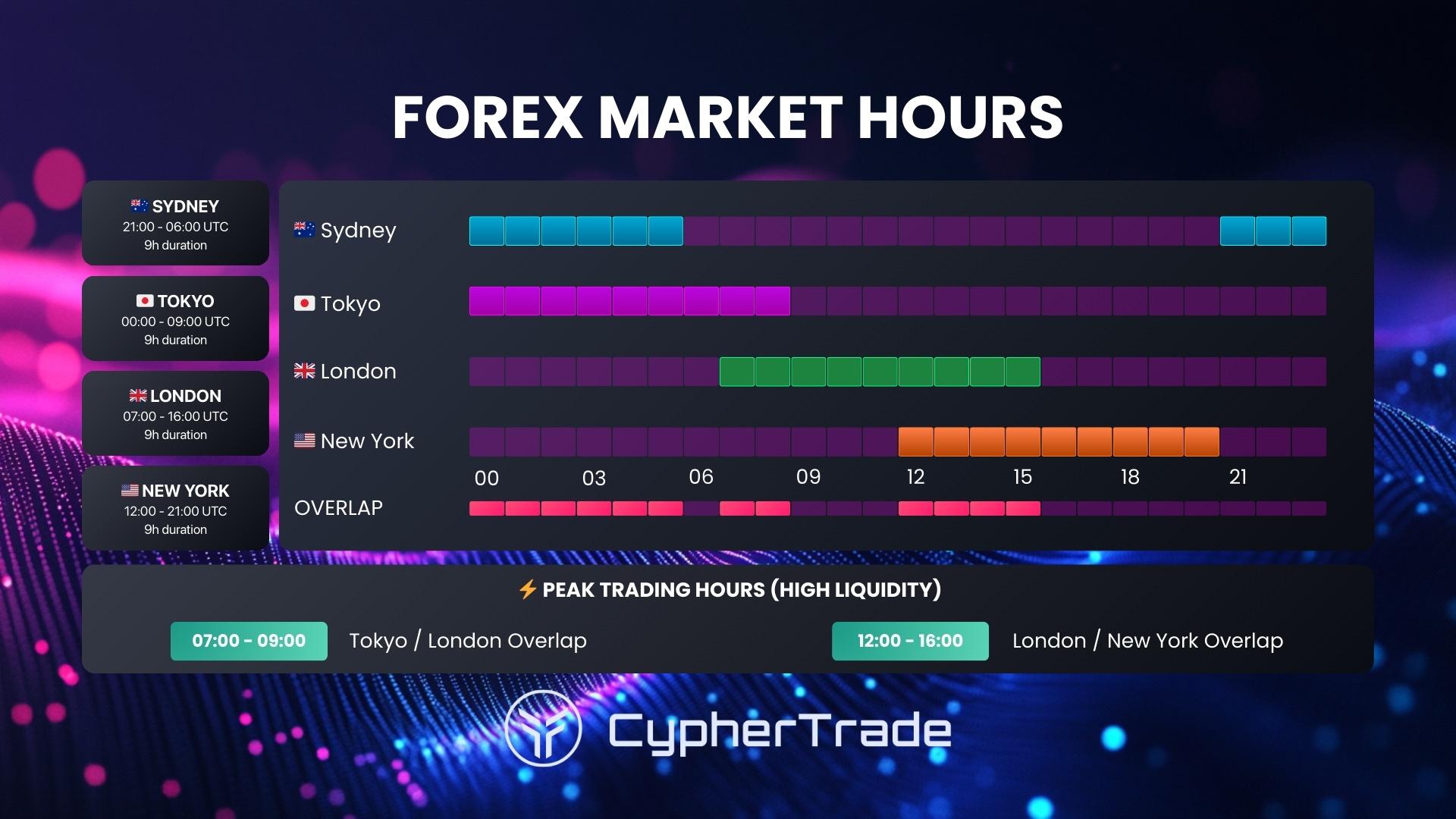

Forex follows the sun. As one financial hub closes, another opens. Sydney hands off to Tokyo, Tokyo to London, London overlaps with New York — and round it goes. Each session has its own personality.

Sydney: The Quiet Start

The Sydney session kicks off the trading week at 5:00 PM EST on Sunday (10:00 PM GMT). And honestly? It’s sleepy. Volume is low, most traders are still recovering from the weekend, and unless you’re specifically trading AUD or NZD pairs, there’s not much happening.

I used to try trading EUR/USD during Sydney. Don’t do that. You’ll watch candles form that look like tiny dashes while your coffee gets cold. Sydney is better suited for analysis and planning than actual execution — at least for major pairs.

Tokyo: Yen Pairs Come Alive

Tokyo runs from 7:00 PM to 4:00 AM EST (midnight to 9:00 AM GMT). This is where yen crosses actually move — USD/JPY, EUR/JPY, GBP/JPY. The Bank for International Settlements puts Tokyo’s share of daily forex volume at around 6%, which sounds small until you realize that’s still billions of dollars changing hands.

If you’re not trading yen pairs though, Tokyo can feel a lot like Sydney. EUR/GBP during this window? It might move 15-20 pips total. That’s not a trading opportunity — that’s watching paint dry.

London: When Things Get Real

At 3:00 AM EST (8:00 AM GMT), London opens — and the market transforms. Spreads tighten. Volume explodes. Price starts moving with actual conviction.

London handles roughly 38% of global forex turnover according to the BIS 2022 data. That’s not a typo. More than a third of all forex trading happens through London. When the city wakes up, so does your chart.

The first couple hours after London opens can be aggressive. Institutional traders are positioning, overnight orders are getting filled, and EUR/USD often makes 70-80% of its daily range during this session alone. If you’ve been waiting for “the move,” this is usually when it happens.

New York: The Overlap Sweet Spot

New York enters at 8:00 AM EST (1:00 PM GMT) and for a few hours, both London and New York are trading simultaneously. This London-New York session overlap — running until about noon EST — is the most liquid, most volatile window in the entire forex market.

We’re talking maximum participation. Tightest spreads. Biggest moves. Major US economic releases like Non-Farm Payrolls, CPI prints, and FOMC decisions drop during this window. I’ve seen EUR/USD move 80 pips in under five minutes on NFP day. That’s the overlap in action.

Session Times at a Glance

Quick reference if you need to convert to your time zone:

| Session | EST (New York) | GMT (London) | AEST (Sydney) |

| Sydney | 5:00 PM – 2:00 AM | 10:00 PM – 7:00 AM | 8:00 AM – 5:00 PM |

| Tokyo | 7:00 PM – 4:00 AM | 12:00 AM – 9:00 AM | 10:00 AM – 7:00 PM |

| London | 3:00 AM – 12:00 PM | 8:00 AM – 5:00 PM | 6:00 PM – 3:00 AM |

| New York | 8:00 AM – 5:00 PM | 1:00 PM – 10:00 PM | 11:00 PM – 8:00 AM |

| London-NY Overlap | 8:00 AM – 12:00 PM | 1:00 PM – 5:00 PM | 11:00 PM – 3:00 AM |

Heads up: these shift by an hour during Daylight Saving Time transitions. More on that headache later.

Why Liquidity Actually Matters (It’s Not Just Theory)

“Liquidity” gets thrown around a lot in trading education. Let me make it concrete.

During the London-New York overlap, EUR/USD spreads with a decent broker might run 0.1 to 0.3 pips. During the late Asian session? That same pair could show 0.8, 1.2, maybe 1.5 pips. Doesn’t sound like much until you do the math.

Say you’re scalping 20 trades per week. An extra pip per trade adds up to 20 pips gone — just in spread costs. Over a month, that’s 80 pips. Over a year? Nearly a thousand pips vanished before you even start measuring your actual performance. That’s the difference between a profitable scalper and someone slowly bleeding out.

And it’s not just spreads. Slippage gets worse in thin markets too. During liquid hours, you click buy, you get filled at your price. During Sydney on a slow Monday? You might get filled 2-3 pips worse — especially if you’re trading any size.

This is why trading GBP/JPY with a tight stop during Sydney is fundamentally different from trading it during London. Same chart. Same pattern. Completely different execution reality. The spread alone might eat 25% of your stop distance before price even moves against you.

Exotic pairs make this even more brutal. EUR/TRY or USD/ZAR during off-hours? I’ve seen spreads balloon to 30, 40, 50+ pips. Unless you’re swing trading with targets that make those costs irrelevant, stay away during thin sessions.

Volatility Isn’t Random — It’s Predictable

One thing I wish someone had drilled into me earlier: volatility follows a schedule. It’s not some chaotic force that strikes randomly. It shows up when traders show up.

London open? Volatility spikes. New York enters? Spikes again. Both sessions close? Things calm down.

The London session consistently delivers the biggest moves for European pairs. That 70-80% daily range figure for EUR/USD during London hours isn’t a fluke — we see it repeatedly in broker data. The market makes its decisions when institutional money is at the desk.

The overlap period amplifies this further. You’ve got London traders still active, New York traders coming in fresh, and major economic data potentially dropping. It’s concentrated activity. That’s why the 8:00 AM to noon EST window gets so much attention.

Now, here’s where traders get it wrong: assuming high volatility automatically means good trading.

Not quite.

During major news releases, yes, price moves — but spreads blow out, orders slip, and gaps can appear mid-candle. The “cleanest” opportunities usually come during elevated but controlled volatility. Think the first hour or two after London opens on a day without major scheduled news. Price is moving, but it’s moving in a tradeable way.

Match Your Strategy to the Right Session

This is where the rubber meets the road. Your strategy isn’t broken. It’s probably just being applied during the wrong hours.

Scalping

If you’re scalping, you need tight spreads and actual movement. That means London-New York overlap, period. Trying to scalp EUR/USD during Sydney is an exercise in frustration — spreads eat your profits while you wait for price to do something.

I learned this the hard way. Sat there for three hours once, took four trades, paid more in spread than I made in winners. Never again.

Breakout Trading

Breakouts need volatility expansion to work. And guess when volatility expands? Session opens. Particularly London.

The pattern is almost textbook: price ranges during Asian hours, compresses into a tight channel, then London opens and blows through one side. If you’re trading breakouts, aligning your entries with that London volatility expansion dramatically improves your hit rate.

Range Trading

Flip side — if your strategy fades moves at support and resistance, you actually want the quiet sessions. Asian hours for non-yen pairs. The dead zone between New York close and Sydney open. These windows favor mean-reversion because trending moves are less likely to run you over.

News Trading

This one’s tricky. Economic releases create volatility spikes, but they also create terrible execution conditions. Most news traders at CypherTrade wait 5-15 minutes after major releases for the dust to settle before entering. Trying to catch the initial spike usually means getting filled at the worst possible price.

Check Forex Factory’s calendar or a similar economic calendar religiously if you’re trading around news.

Swing Trading

Longer timeframes are less session-dependent since you’re holding through multiple sessions anyway. But entry timing still matters. I prefer entering swings during the overlap when spreads are tightest and I can see how price reacts to my level in real-time. Entering right before NFP? That’s just adding unnecessary risk.

A Note on Your Schedule

Look, we can talk about optimal forex market hours all day, but if London open is 3:00 AM your time and you’re not a morning person, theory doesn’t help much.

Be realistic. A trader in Singapore scalping EUR/USD faces a genuine problem — their ideal window is the middle of the night. The solutions are either adapt your strategy to your waking hours, or switch to currency pairs that move when you’re alert. AUD/JPY during Asian hours beats sleep-deprived EUR/USD trading during London every time.

The Daylight Saving Headache

Twice a year, DST messes with session times. And because the US, Europe, and Australia all switch on different dates, there’s a 2-3 week window each spring and fall where everything is off by an hour.

Dates to mark:

- US: Second Sunday in March (forward), first Sunday in November (back)

- Europe: Last Sunday in March (forward), last Sunday in October (back)

- Australia: First Sunday in October (forward), first Sunday in April (back)

During the gaps between US and EU transitions, the London-New York overlap shifts. If you’ve built your entire routine around that 8:00 AM EST overlap, suddenly it’s happening at 7:00 AM or 9:00 AM for a couple weeks. Not a huge deal, but it trips people up.

Weekend Gaps: What Nobody Tells Beginners

The market closes Friday 5:00 PM EST. Opens Sunday 5:00 PM EST. And during those 48 hours, the world keeps spinning.

Elections happen. Central banks make surprise announcements. Geopolitical situations escalate. When Sunday rolls around, price can “gap” — opening at a completely different level than Friday’s close.

I’ve seen Sunday gaps blow through stop losses like they weren’t there. You set a 30-pip stop, price gaps 80 pips against you, and your broker fills you at the first available price. That’s gap risk.

If you’re holding positions over weekends, factor this in. Some traders reduce size before Friday close. Others exit entirely during uncertain periods. There’s no single right answer, but ignoring weekend risk entirely — that’s definitely wrong.

For more on handling this, check our risk management guide.

Putting This Into Practice

Alright, enough theory. Here’s how to actually use this.

Step one: Audit your last 30-50 trades. Note which session each occurred during. Then compare your results by session. Most traders who do this find obvious patterns they weren’t aware of — trades during one session crushing trades during another.

Step two: Build a session schedule for your time zone. Mark opens, closes, overlaps, and major news times. Tape it next to your monitor if you have to.

Step three: Create rules. Something like: “I only scalp EUR/USD between 8:00 AM and 11:00 AM EST” or “No new positions 30 minutes before high-impact news.” Written rules remove in-the-moment decisions about timing.

Step four: Test it. Pick your optimal window based on your audit, trade exclusively during that window for 2-4 weeks, and compare to your previous mixed-session results. Let the data tell you if session focus works for your approach.

Give yourself 4-8 weeks to really internalize this. The patterns become intuitive quickly, but the discipline to pass on “perfect” setups during suboptimal hours? That takes practice.

Wrapping Up

Forex market hours aren’t just trivia. They’re a framework that shapes every trade you take — your spreads, your execution, your probability of catching a real move versus watching paint dry.

The core ideas are simple: liquidity peaks during London and the London-New York overlap. Volatility follows session patterns. Matching your strategy to the right session improves your edge.

You don’t need to overhaul everything. Just be intentional about when you trade. A decent strategy executed during the right hours will outperform a great strategy applied randomly across all sessions.

Start with that trade audit. Find your patterns. Then get disciplined about your timing. The market has a rhythm — work with it instead of against it.

And as always, manage your risk. Better timing improves your odds, but nothing eliminates the inherent risk in leveraged trading. Trade what you can afford to lose.

Risk Disclaimer: Trading forex involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Only trade with capital you can afford to lose. This article is for educational purposes only and does not constitute financial advice.

Common Questions

“What’s the single best time to trade forex?”

For major pairs, the London-New York overlap (8:00 AM–12:00 PM EST) is hard to beat. Tightest spreads, most movement, cleanest execution. But “best” depends on your strategy — range traders might prefer the Asian session specifically because it’s quieter.

“When does forex open Sunday?”

5:00 PM EST with the Sydney session. But liquidity stays thin until Tokyo and especially London open. Most traders don’t consider Sunday evening “real” trading — it’s more of a warm-up.

“Why do my spreads change throughout the day?”

Liquidity. More traders = more competition between prices = tighter spreads. Fewer traders = wider spreads. It’s supply and demand for your order flow.